Why is it essential to run a credit check on a potential tenant?

Most rental property owners will tell you that it’s essential, at minimum, to run a credit check on a potential tenant. Some landlords will say that it’s a way to get to know the person, while others have learned the hard way what the consequences are of choosing a bad payer. For landlords, the process of severing a relationship with a tenant with bad habits is complex, time-consuming and costly.

As a key element to avoid legal proceedings, a background check is an essential part of the new tenant selection process; it confirms that the potential tenant doesn’t have excessive debt or a history of defaulting on payments.

How to interpret a tenant’s credit check

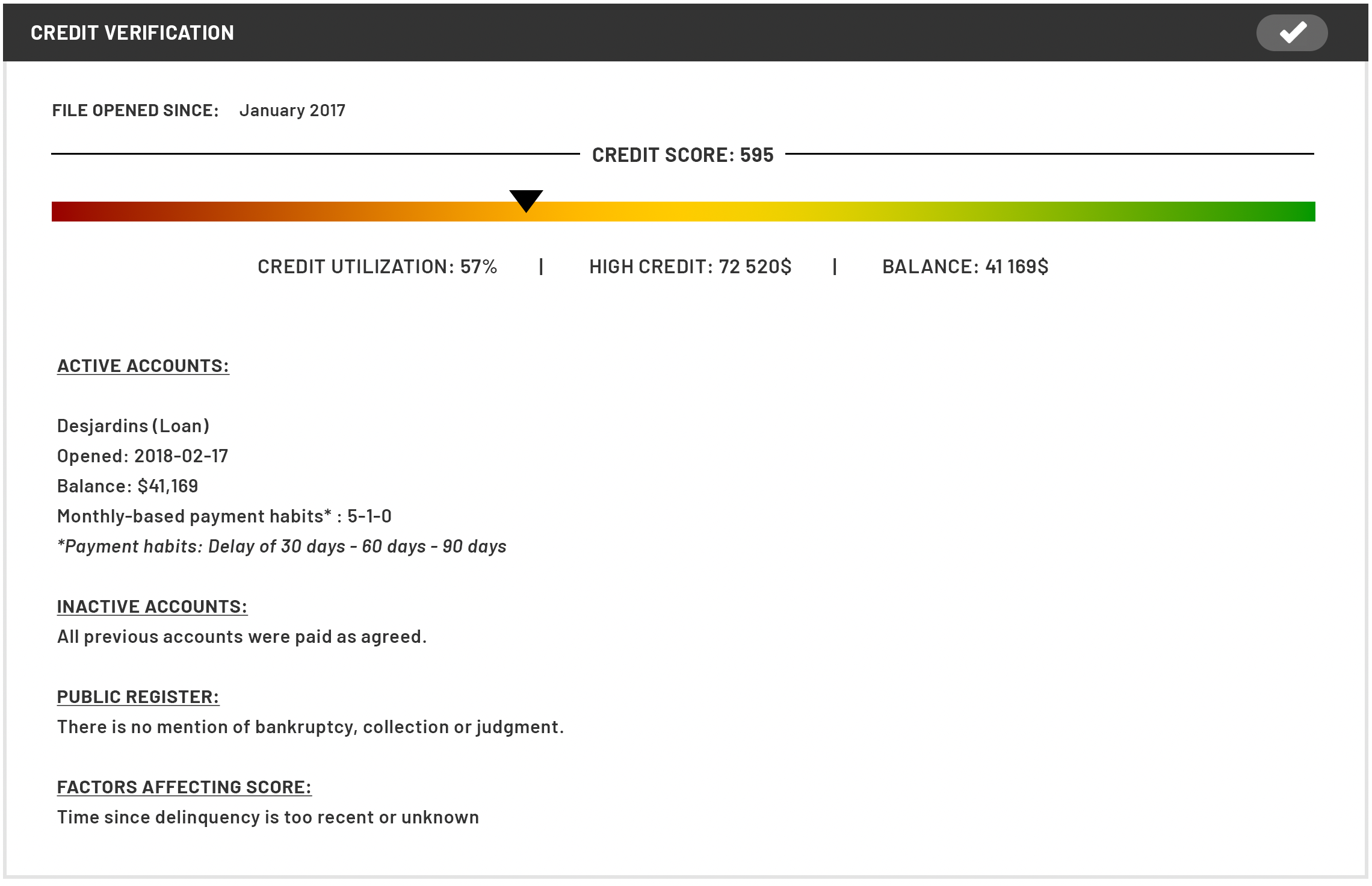

Please note that this is a sample credit check used for illustrative purposes only.

Credit score

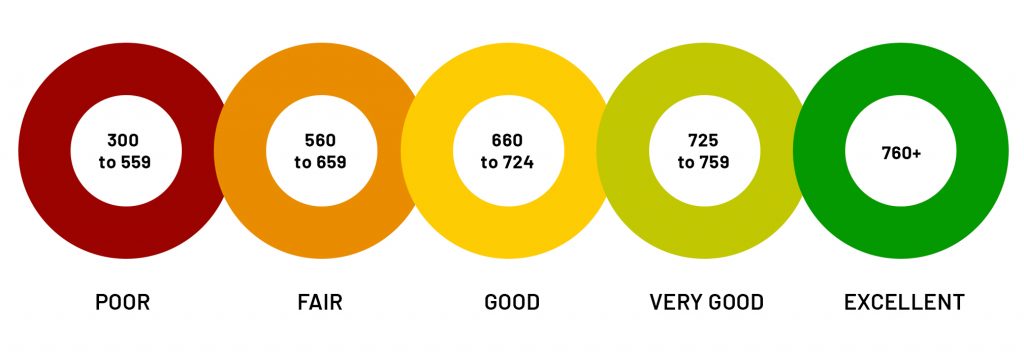

When you work with Trak Group, the credit score you receive is based on the FICO standard, a standard banks use because of its reliability. This score ranges from 300 to 900:

The report will also indicate the factors that affect the score, adjusted to the individual. By clicking here, you can view details of the factors that may affect a person’s credit score according to Equifax standards.

Payment habits

Each active account will list the following information. These elements are the ones to consider when striving to understand a potential tenant’s financial situation:

| Credit report information | Elements to consider/subject to interpretation |

Type of credit

|

Pay special attention to the types of expenses. For instance, are there multiple financings for luxury items such as a motorbike or an ATV. This type of information offers a first clue as to whether the person lives within their means.

|

| Date of account opening |

Have they opened multiple accounts suddenly? Why? Opening multiple credit cards, lines of credit, or financings can mean an pressing need for cash for expenses that the person cannot afford.

|

| Balance |

This information offers a snapshot of the potential tenant’s monthly expenses that need to be added to the calculation of their ability to pay the rent. See below for the recommended ratio of rent expenses to monthly income.

|

| Payment habits |

These numbers indicate how many times the person has been in arrears according to their length (30-60-90 days).

In the example above, 5-1-0 means that the applicant has had 5 30-day delays, 1 60-day delay, and no delays of 90 days or more for their financing with Desjardins.

|

What is High Credit ?

The last line of the credit check provides information about the following:

- Credit use means the percentage of credit used in relation to the total borrowing capacity.

- High credit means the highest total amount borrowed by the applicant.

- Balance means the amount owed by the applicant as of the date of the survey.

What to consider when calculating a potential tenant’s capacity to pay?

Using all the information on the credit report and the details of the potential tenant’s income, you can make an informed decision as to the person’s ability to pay. As explained in this La Presse article (text in French), the recommended ratio for rent is 25%, and it should not exceed 35% of monthly expenses.

Our recommendations

In addition to the credit check, we recommend confirming a potential tenant’s employment to validate their income and job stability, conducting a Tribunal administratif du logement search to assess the applicant’s history as a tenant, and checking the tenant’s habits (cleanliness, noise, etc.) with their previous landlord(s)/concierge(s).

We also recommend that you read about privacy guidelines on the TAL website by clicking here.

Find out more about Groupe Trak’s tenant investigation services by visiting the Groupe Trak website.